best retirement plan malaysia

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. GOLDEN HERITAGE Golden Heritage positions itself as an industry pioneer in providing quality senior living lifestyle and support services within its capacity as premier senior living property developer and a full-service advisory organization.

Construction Jobs In Saudi Monster Gulf Has A Complete List Of Saudi Arabia Construction Jobs Visit Now To Fi Retirement Parties Early Retirement Retirement

More mileage for your money when you really do retire in Malaysia.

. To have a meaningful comparison Ill choose the top 5 PRS performers from each category in Core Funds. On top of all this it also boasts relatively inexpensive living costs so its no wonder American retirees are heading to MalaysiaIf you want to retire in this southeast Asian nation youll need to understand things like the culture visa. The earlier you plan to retire the more youll have to save and invest.

As a starting reference point last year the EPF suggested that an elderly couple living in the Klang Valley would need at least RM3090 a month to achieve a reasonable standard of living. Malaysia was also ranked third among Asian retirement systems and 19th among 39 retirement income systems worldwide in the 2020 rating. One of the main reasons why Malaysia is the best place for retirees is its excellent government schemes.

If you are disabled or unfortunately pass away due to illness this plan pays your loved ones up to 125 of your coverage or the. Malaysia currency exchange April 2012. But just not for the reasons they list.

It is a type of visa that allows foreign nationals to live in Malaysia for 10 years. Malaysia has a lot to offer retirees from its sandy beaches and extensive rainforests to its dazzling capital city of Kuala Lumpur. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to voluntarily supplement their retirement savings under a well-structured and regulated environment.

Suffice to say that if you are an American Canadian or British planning to retire to Malaysia this is one of the best times to maximize the value of your retirement nest egg at 1 Dollar 4 Ringgit. And then another top 5 PRS performers from Non-Core funds. Generally there are 2 types of fundamental retirement plan for the Malaysian workforce your EPF and pension scheme if youre a government servant.

Sun Life Malaysia Assurance Berhad Registration No. Malaysia is almost always in the top 10 lists of best international places for expat living and retirement and for good reason. Allocate at least 15 to 20 of your current income for retirement savings whether you are employed in public private sector or self-employed.

Sun Life Malaysia offers savings insurance plans that have insurance coverage and investment returns for a peace of mind in retirement. We live longer we have a longer lifespan than ever before due to medical and technology advancements. Malaysia improved its adequacy score to 506 this year one of the three sub-indices examined in the 2021 index.

100 EUR 404221 MYR. Firstly visit Morningstar the portal that publishes PRS daily fund prices and historical returns. Retirement ManuSecure Series Build your wealth for a financially secure future.

Integrity received the best grade 768 followed by sustainability 575 and adequacy. Malaysia My Second Home Programme MM2H is an initiative taken by the government for the retired foreign nationals. Find out more about PRS here.

For just USD 250000 you are literally a Ringgit millionaire. The National Heart Institute in Malaysia is capable of handling all types of heart surgery from normal routine angiograms to the most complex bypass surgery. The retirement homes have been arranged in no particular order.

Starting from pre-retirement to the end of life you should know what to expect and prepare ahead of time. PRS is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement. Investment Lifestyle Money Management Retirement planning.

Cheng survives on a minimal RM700 per month Mrs. EPF Members Savings At A Worrying Level Many With Less Than RM10000. PRURetirement Growth guarantees you income and income growth according to your plans for a fulfilling retirementIt is an investment-linked plan that pays you higher guaranteed returns and allows flexible withdrawals.

As a rough guide the figure could range from RM50 per month RM600 per annum to RM300 RM3600. According to the EPF a good guideline to follow is to allocate 30 of the income for savings which is linked to the goal of being comfortably retired. What You Should Know About The 6 Stages To Retirement.

EPF members need help to replenish their retirement savings given the significant pre-retirement withdrawals made during the Covid-19 pandemic. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Retirement Manulife Universal Saver.

However your actual figure will depend on. One of the best places to retire in the Asia. Cheng a housewife aged 74 with four daughters is currently living with her youngest daughter while the rest are living with their own family.

News has again and again saying that these plans alone will not be enough. Retirement Saving aside some money ahead to live a blissful phase of life after retirement is definitely worth it when you know you have chosen the best plan. Plan your retirement wisely for a laid-back future.

Now let me show you exactly how to choose the best PRS Malaysia to invest today. Retire the way you want. Rate of return the amount you need at your desired retirement age is S108637451 With an existing provision of RM you will face a total shortfall of S0 To maintain your desired retirement lifestyle you will need to save per month from now The annual inflation rate is 3.

Those 10 Best write-ups are hilarious fantasy fictions written by people who are either completely high closely related to Pinocchio or have never set foot. 100 USD 306511 MYR US Dollar Malaysian Ringgit.

Step By Step Guide To Retirement Planning For Malaysians Maybank Malaysia

The Top 5 Countries In Asia To Retire Expat Financial Global Medical

Five Best Retirement Places In Malaysia For Expats

Five Best Retirement Places In Malaysia For Expats

Best Places To Retire In 2022 The Annual Global Retirement Index

How Much Do You Actually Need To Retire In Malaysia Free Malaysia Today Fmt

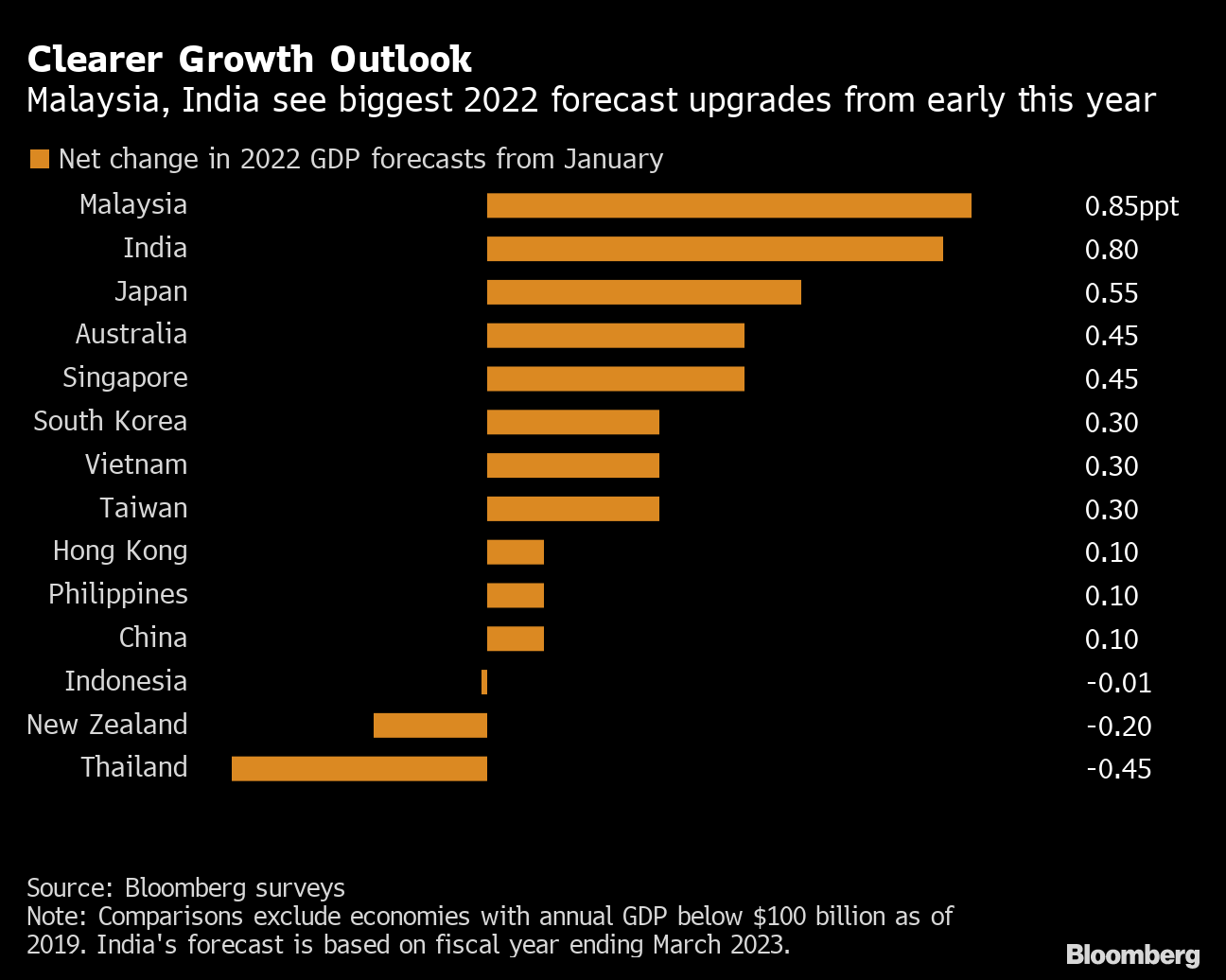

Malaysia India Top Asian Forecasts For Faster Growth In 2022 Bloomberg

6 Must Dos To Include In Your Retirement Plan In Your 20s Infographic Career Resources

Five Best Retirement Places In Malaysia For Expats

The State Of The Nation Putting Old Age Security Within Reach Of Malaysians Without Public Pension Rm1 Mil Savings The Edge Markets

The 18 Best Financial Advisors In Malaysia 2022

How To Achieve Financial Independence Retire Early Fire In Malaysia Maybank Malaysia

Five Best Retirement Places In Malaysia For Expats

Should I Retire To Malaysia Mom Jobs Retirement Money Saving Mom

The State Of The Nation Putting Old Age Security Within Reach Of Malaysians Without Public Pension Rm1 Mil Savings The Edge Markets

Five Best Retirement Places In Malaysia For Expats

Step By Step Guide To Retirement Planning For Malaysians Maybank Malaysia

0 Response to "best retirement plan malaysia"

Post a Comment